Managing finances as a freelancer can be a juggling act. Between unpredictable income and the responsibility of self-employment taxes, saving for the future often takes a backseat. Catch is an intuitive app specifically designed to streamline savings for freelancers, covering everything from taxes and retirement to time off and health insurance. But does it live up to its promise of simplifying financial wellness? Let’s dive into the details of what Catch offers and see if it’s the right fit for you.

What is Catch?

Catch is a financial platform designed to simplify saving and planning for the financial future of freelancers, independent contractors, and self-employed individuals. Instead of being a one-size-fits-all financial tool, Catch focuses on breaking down financial planning into manageable chunks, making it less overwhelming for those new to the world of self-employment.

How Catch Works

Catch simplifies financial planning by guiding users through a series of questions about their work, income, and current benefits. This personalized approach helps the app recommend relevant savings options tailored to individual needs. Whether it’s setting aside money for taxes, planning for retirement, or exploring health insurance options, Catch provides the tools and guidance to make informed financial decisions.

Key Features of Catch

Catch offers a range of features designed to make financial management easier for freelancers:

- Automated Tax Withholding: Catch calculates and sets aside the appropriate amount from each paycheck for taxes, eliminating the guesswork and stress of quarterly tax payments.

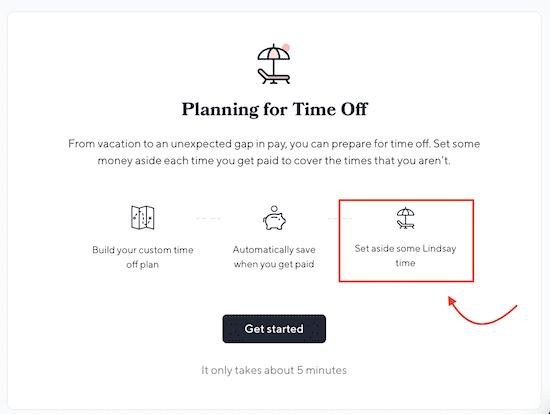

- Personalized Savings Goals: Users can set up savings goals for various purposes, such as time off, retirement, or a rainy-day fund, with Catch automating the savings process.

- Retirement Planning: Catch helps determine the right retirement savings strategy based on risk tolerance and future goals, offering curated investment portfolio options.

- Health Insurance Navigation: The app provides access to a curated marketplace of health insurance plans tailored for freelancers, simplifying the often-confusing process of finding suitable coverage.

- Additional Benefits: Catch also offers resources and information on other benefits relevant to freelancers, including disability insurance, life insurance, and student loan refinancing options.

In-Depth Review of Catch

Catch shines in its ability to demystify complex financial concepts for freelancers. The user-friendly interface and straightforward explanations make it easy to understand the importance of each saving category. Setting up an account is a breeze, and the app seamlessly integrates with bank accounts for automated transfers.

One of the standout features is the tax withholding calculator. Freelancers often struggle with setting aside enough money for taxes, and Catch eliminates this headache by accurately estimating and withholding the necessary amount. This feature alone provides peace of mind and can prevent potential financial strain come tax season.

While Catch excels in many areas, there are a few areas where it could improve. The retirement planning section, while helpful, might feel overwhelming for users with limited investment knowledge. Expanding educational resources or offering access to certified financial advisors could enhance this feature.

Additionally, the “Time Off” category, while a useful concept, lacks customization. Allowing users to create multiple subcategories within “Time Off” for specific goals, like vacations or personal projects, would enhance its functionality.

Catch Pros and Cons

Here’s a summarized look at the advantages and disadvantages of using Catch:

Pros:

- User-Friendly Interface: Simple and intuitive design makes navigation and setup easy.

- Automated Savings: Effortlessly save towards goals with automatic transfers.

- Accurate Tax Withholding: Eliminate tax-season stress with automatic calculations and deductions.

- Personalized Recommendations: Receive tailored advice based on individual financial situations.

Cons:

- Limited Retirement Planning Guidance: Users with limited investment knowledge might need more support.

- Lack of “Time Off” Customization: Inability to create subcategories for different savings goals.

- Limited Availability: Catch is currently only available to US-based freelancers.

Catch Pricing and Packages

Catch operates on a transparent pricing model with no hidden fees. The basic version of the app, which includes core features like automated savings and tax withholding, is free to use. Catch generates revenue through partnerships with financial institutions for its premium offerings, such as health insurance and retirement accounts.

Catch Alternatives

While Catch is a strong contender in the freelance finance space, exploring alternative options is always a good idea. Here are a few notable alternatives:

- Lili: Offers a suite of banking and financial management tools tailored for freelancers.

- Freshbooks: Popular accounting software with invoicing and expense tracking features.

- Quickbooks Self-Employed: Designed for self-employed individuals and small business owners.

Conclusion

Catch is a valuable tool for freelancers seeking to simplify their financial management. Its automated features, personalized recommendations, and focus on tax withholding make it a standout option for those new to freelancing or struggling to stay organized. While there’s room for improvement in areas like retirement planning and category customization, Catch’s strengths lie in its user-friendly approach and dedication to making financial wellness accessible to all. Give Catch a try and see the difference it can make in taking control of your freelance finances.