My journey as a retail investor started like many others – drowning in a sea of free data. I spent countless hours poring over Finviz charts, MarketWatch news, and endless spreadsheets, trying to piece together a coherent investment strategy. It was a time-consuming, often frustrating process. Then, a colleague mentioned Koyfin. Initially skeptical, I decided to give it a try, and my investment analysis workflow transformed. This Koyfin review will explain why.

What is Koyfin?

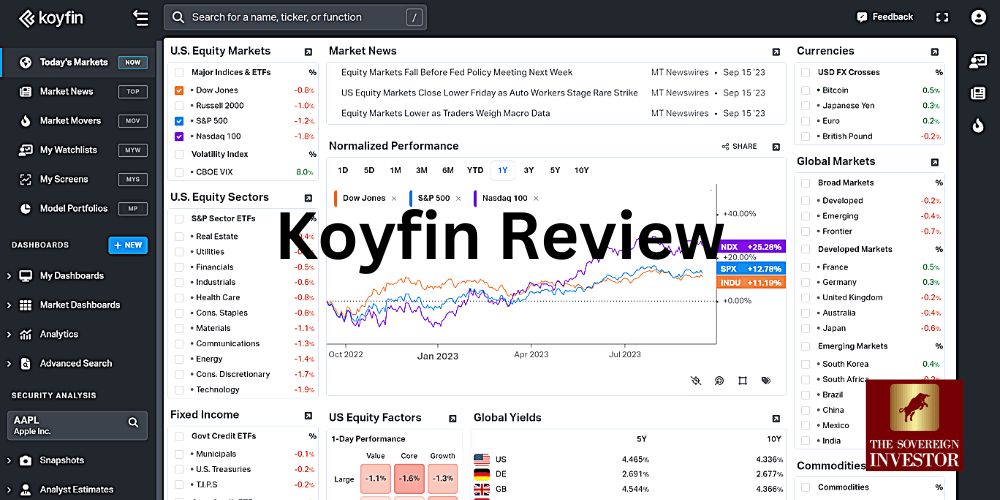

Koyfin is a powerful financial data platform designed to provide investors with comprehensive market insights. Unlike free services that offer only surface-level data, Koyfin delves deep, offering a wealth of information usually found only in expensive professional terminals like Bloomberg. It’s a game-changer for serious investors who want more than just stock charts.

How Koyfin Works: A Deep Dive into the Data

Koyfin’s strength lies in its ability to consolidate information from diverse sources. Think of it as a central hub for all your financial data needs. You can access:

Key Data Points:

- Real-time Stock Prices and Charts: Koyfin provides up-to-the-minute pricing and charting tools, similar to what you’d find on Finviz but with a much more robust feature set.

- Analyst Ratings and Price Targets: Go beyond simple buy/sell recommendations and see the detailed reasoning behind analyst ratings, including their price targets and historical accuracy.

- Financial Statements: Access comprehensive financial statements, including balance sheets, income statements, and cash flow statements, enabling a deeper understanding of a company’s financial health.

- Earnings Call Transcripts: Read transcripts from company earnings calls, giving you direct access to management’s commentary and insights into the company’s performance and future plans.

- Regulatory Filings: Stay informed with access to critical regulatory filings (SEC filings in the US, and equivalent documents in other markets).

- International Market Coverage: Koyfin isn’t limited to the US; it extends its coverage to emerging markets in Vietnam, Singapore, and many other countries, providing a truly global perspective.

Key Features that Set Koyfin Apart:

- Intuitive Interface: The platform is surprisingly user-friendly, even for those unfamiliar with sophisticated financial software. Navigating the data and finding what you need is quick and efficient.

- Customizable Dashboards: Create personalized dashboards to track your investments and monitor key metrics. This allows for a tailored investment monitoring experience.

- Powerful Screening Tools: Quickly screen for stocks based on specific criteria, helping you identify potential investment opportunities that meet your specific needs.

- Advanced Charting Capabilities: Go beyond basic candlestick charts. Koyfin offers advanced charting tools to perform technical analysis and gain deeper insights into price trends.

In-depth Koyfin Review: My Personal Experience

Before Koyfin, my investment process was fragmented and inefficient. I spent more time gathering data than analyzing it. Koyfin changed that. The ability to access comprehensive financial statements, analyst reports, and earnings call transcripts in one place has significantly improved my understanding of companies and my decision-making process. The international coverage is also a major plus, allowing me to explore investment opportunities beyond my usual geographical limitations. The cost-effectiveness is another significant advantage over professional-grade platforms like Bloomberg.

Benefits of Using Koyfin:

- Time Savings: Consolidates all your financial data into one platform, saving you countless hours of research.

- Improved Decision-Making: Provides comprehensive data and insights to support more informed investment decisions.

- Enhanced Understanding of Companies: Offers deep dives into company financials, analyst opinions, and management commentary.

- Global Perspective: Expands your investment horizons by providing coverage of international markets.

- Cost-Effective: Offers a valuable alternative to expensive professional-grade financial data platforms.

Koyfin Pricing and Plans:

Koyfin offers various subscription plans to suit different needs and budgets. Check their website for the most up-to-date pricing information. They typically offer a free trial period, allowing you to test the platform before committing to a subscription.

Koyfin vs. Other Financial Data Platforms:

Compared to free options, Koyfin provides significantly richer data and more advanced analytical capabilities. Compared to professional platforms like Bloomberg, it offers a more affordable and accessible alternative without sacrificing much in terms of data quality for the average retail investor.

Important Considerations:

While Koyfin is a valuable tool, remember that it’s only as good as the data it provides. Always conduct your own thorough due diligence before making any investment decisions. Relying solely on any single data source, even Koyfin, is not recommended.

Conclusion:

Koyfin has proven to be an invaluable asset in my investment journey. It’s a game-changer for serious retail investors who want access to comprehensive financial data without breaking the bank. If you’re looking to elevate your investment analysis, I highly recommend giving Koyfin a try. By leveraging tools like Koyfin, you can enhance your decision-making process and potentially achieve better investment results. At FEC, we specialize in helping businesses like yours leverage the power of digital marketing—including affiliate marketing, Google Ads, and SEO—and we’re committed to helping you integrate AI into your business strategy. Contact us today to learn how we can help you grow your business!